What are the benefits of having car insurance in California? In a state known for its beautiful highways and bustling cities, the need for car insurance is paramount. It’s not just a legal requirement, it’s a shield against the unexpected.

From protecting your finances in the event of an accident to providing peace of mind on the road, car insurance offers a range of benefits that every Californian driver should consider.

Imagine this: you’re cruising down the Pacific Coast Highway, enjoying the scenic views, when suddenly, an unexpected event throws your journey into chaos. A fender bender, a medical emergency, or even a natural disaster can leave you facing significant financial burdens.

Car insurance acts as a safety net, providing financial protection, legal compliance, and a sense of security that allows you to navigate these challenges with greater confidence.

Peace of Mind

Driving in California can be stressful, especially with the unpredictable weather and heavy traffic. But having car insurance can provide you with a sense of security and peace of mind, knowing you’re protected in case of an accident. This peace of mind can be invaluable, especially when facing unexpected challenges on the road.

Financial Protection

Car insurance provides financial protection in case of an accident, helping you cover expenses like medical bills, vehicle repairs, and legal fees. This financial protection can alleviate the stress and anxiety associated with potential financial losses. For example, if you’re involved in an accident and your vehicle is damaged, your insurance will cover the cost of repairs or replacement, saving you from a hefty bill.

Legal Assistance

In the event of an accident, car insurance can provide legal assistance, protecting you from potential lawsuits or claims. This can be especially important in situations where you’re not at fault, as your insurance company will handle the legal process, giving you peace of mind and allowing you to focus on recovering.

Examples of Peace of Mind

Car insurance has helped many drivers overcome challenging situations and regain a sense of normalcy. For example, a driver involved in a hit-and-run accident was able to rely on their insurance to cover the repairs and medical bills, allowing them to focus on their recovery without worrying about the financial burden.

Access to Benefits and Services

In addition to the financial protection provided by car insurance, California insurers offer a range of valuable benefits and services that can enhance your driving experience and provide assistance in emergencies. These services go beyond simply covering repairs and can make a significant difference in stressful situations.

Roadside Assistance

Roadside assistance is a valuable service that can help you out of a bind when you’re stranded on the road. Many California car insurance policies include roadside assistance as a standard feature. These services typically cover situations like:

- Flat tire changes: Roadside assistance will dispatch a technician to your location to change your flat tire. This can save you time and hassle, especially if you’re not comfortable changing a tire yourself.

- Jump starts: If your car battery dies, roadside assistance can send a technician to jump-start your car. This can be a lifesaver if you’re stuck in a remote area or during a time of day when auto shops are closed.

- Towing: If your car is unable to be driven, roadside assistance will tow it to a nearby repair shop or your chosen location. This can be a huge relief if you’re stranded far from home or in a dangerous area.

- Fuel delivery: If you run out of gas, roadside assistance can deliver a small amount of fuel to get you to a gas station. This can be a lifesaver if you’re in a hurry or if you’re driving in a remote area.

Roadside assistance can be a lifesaver in emergency situations, like when you’re stranded on the side of the road at night or in a dangerous area.

Rental Car Coverage

If your car is damaged in an accident or needs repairs, rental car coverage can help you stay mobile while your car is being fixed. This coverage pays for a rental car for a limited period of time, so you can still get around while your car is in the shop.

- Convenience: Rental car coverage allows you to continue your daily routine without interruption, whether you need to get to work, school, or appointments.

- Cost savings: Rental car coverage can save you money by avoiding the expense of renting a car yourself. The coverage is usually included as part of your car insurance policy, so you don’t have to pay extra.

Accident Forgiveness Programs

Accident forgiveness programs are a valuable benefit that can help you avoid a rate increase after your first accident. These programs are offered by many California car insurance companies and can provide peace of mind knowing that your rates won’t be affected by a single accident.

- Financial protection: Accident forgiveness programs can help you avoid a significant increase in your insurance premiums, which can be especially helpful if you’re on a tight budget.

- Peace of mind: Knowing that your rates won’t be affected by a single accident can give you peace of mind and help you feel more confident on the road.

Accident forgiveness programs are a valuable benefit that can help you avoid a rate increase after your first accident, providing peace of mind and financial protection.

Discounts and Savings

Car insurance in California offers various discounts that can significantly reduce your premiums and help you save money. By understanding and leveraging these discounts, you can potentially lower your insurance costs and get the best value for your coverage.

Types of Discounts

Many factors can influence your insurance premiums, and insurance companies often offer discounts to incentivize safe driving practices and responsible behavior. These discounts can be categorized into several types, each designed to reward specific actions or characteristics.

- Safe Driving Discounts:These discounts are awarded to drivers with a clean driving record, demonstrating responsible driving habits. For example, if you have no accidents or traffic violations for a specific period, you might qualify for a safe driving discount.

- Good Student Discounts:These discounts are often offered to students who maintain a certain grade point average (GPA). Insurance companies recognize that good students are more likely to be responsible drivers.

- Multi-Car Discounts:If you insure multiple vehicles with the same insurance company, you can often qualify for a multi-car discount. This discount reflects the reduced risk associated with insuring multiple vehicles with the same insurer.

- Other Discounts:Many other discounts are available, such as discounts for anti-theft devices, vehicle safety features, and even discounts for paying your premiums in full or on time.

Maximizing Savings, What are the benefits of having car insurance in California?

Finding the best insurance rates and maximizing your savings through available discounts can be a straightforward process.

- Compare Quotes:Get quotes from multiple insurance companies to compare prices and discounts. This will give you a clear picture of the best rates available for your needs.

- Ask About Discounts:When you contact an insurance company, be sure to ask about all the discounts you might qualify for. Don’t hesitate to inquire about discounts for safe driving, good student status, multi-car coverage, and any other applicable options.

- Review Your Policy:Periodically review your insurance policy to ensure you’re still taking advantage of all available discounts. Your circumstances may change, and you may qualify for new discounts.

- Bundle Your Policies:Consider bundling your car insurance with other types of insurance, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling multiple policies.

Summary

In conclusion, car insurance in California isn’t just a legal obligation; it’s a smart decision that can safeguard your finances, protect you from legal liabilities, and provide peace of mind on the road. With its comprehensive coverage options, valuable benefits, and potential for significant savings, car insurance empowers you to drive with confidence and enjoy the freedom of the open road knowing you’re protected from the unexpected.

Common Queries: What Are The Benefits Of Having Car Insurance In California?

What happens if I get into an accident without car insurance in California?

Driving without car insurance in California is illegal and can result in fines, license suspension, and even legal repercussions. You could be held personally liable for any damages or injuries caused in an accident, potentially leading to significant financial losses.

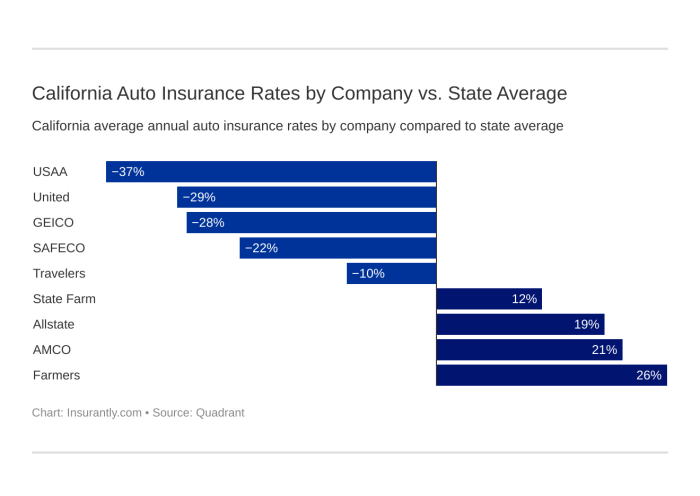

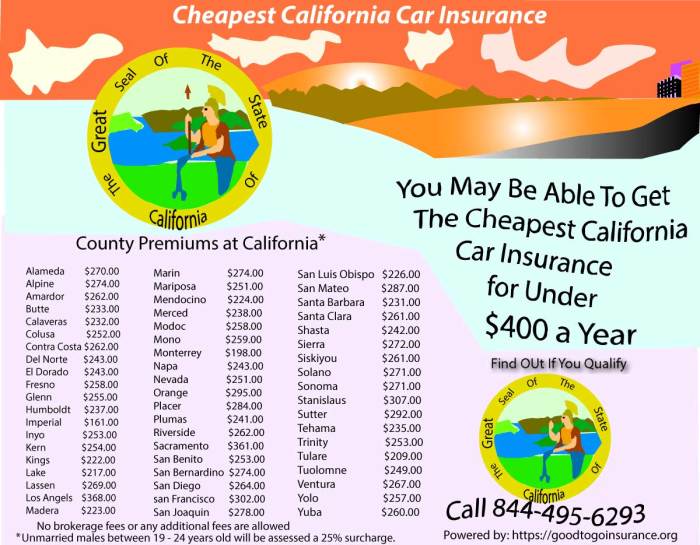

How much does car insurance typically cost in California?

Car insurance costs in California vary depending on factors such as your age, driving history, vehicle type, and location. It’s recommended to compare quotes from multiple insurance providers to find the best rates for your specific needs.

Can I get car insurance if I have a poor driving record?

While a poor driving record can increase your insurance premiums, it’s still possible to get car insurance. You may need to explore options with specialized insurers or consider increasing your coverage limits to secure a policy.