Best car insurance providers for people who want to pay monthly? You’re not alone! Lots of people find it easier to manage their budget with monthly car insurance payments. But it’s not always easy to figure out which providers offer the best deals and the most flexible options.

We’ll break down everything you need to know about finding the perfect monthly car insurance plan for you, from the pros and cons to top providers and tips for saving money.

Think about it like this: You’re driving down the road, and you need to choose the best lane to get to your destination. With car insurance, you need to pick the right provider and plan to keep your wallet happy and your coverage strong.

We’ll help you navigate the options so you can feel confident in your choice.

Understanding Monthly Payment Options: Best Car Insurance Providers For People Who Want To Pay Monthly

Paying your car insurance monthly can be a great option for managing your finances, especially if you prefer predictable, smaller payments. But before you dive in, it’s essential to understand the pros and cons of this payment method.

Benefits of Monthly Payments

Monthly payments offer several advantages, making them a popular choice for many car insurance policyholders. Here are some key benefits:

- Budgeting:Monthly payments make it easier to budget for your car insurance, as you’ll have a consistent expense each month. This can help you avoid surprises and better manage your overall finances.

- Flexibility:Monthly payments provide flexibility, allowing you to adjust your budget if needed. For instance, if you experience a financial hardship, you might be able to temporarily reduce your monthly payment or postpone it, subject to your insurer’s policies.

- Credit Building:Some insurance companies report your monthly payments to credit bureaus, which can help build your credit score. This can be beneficial when applying for loans or credit cards in the future.

Drawbacks of Monthly Payments

While monthly payments offer convenience, it’s crucial to be aware of the potential drawbacks.

- Interest Charges:Some insurers may charge interest on monthly payments, especially if you choose to pay over an extended period. This can add up over time, increasing your overall cost.

- Higher Overall Cost:Paying monthly can sometimes result in a slightly higher overall cost compared to paying annually. This is because insurers may factor in administrative costs associated with processing monthly payments.

- Potential for Late Fees:If you miss a monthly payment, you may be charged late fees, which can significantly impact your finances.

Comparing Monthly Payment Options, Best car insurance providers for people who want to pay monthly

Different car insurance providers offer varying monthly payment options. Here are some factors to consider when comparing:

- Interest Rates:Compare the interest rates charged on monthly payments. Opt for insurers with lower interest rates to minimize your overall cost.

- Payment Flexibility:Assess the flexibility offered by different insurers. Some insurers might allow you to adjust your payment amount or schedule, while others might have stricter policies.

- Credit Reporting:If you’re looking to build credit, consider insurers that report your payments to credit bureaus.

- Late Fee Policies:Understand the late fee policies of different insurers. Choose providers with reasonable late fees and clear communication regarding missed payments.

Top Car Insurance Providers for Monthly Payments

Paying for car insurance monthly can make budgeting easier and help you manage your finances more effectively. Many insurance companies offer flexible monthly payment plans, allowing you to spread out the cost of your coverage over time.

Top Car Insurance Providers for Monthly Payments

Here are five of the top car insurance providers that offer flexible monthly payment plans:

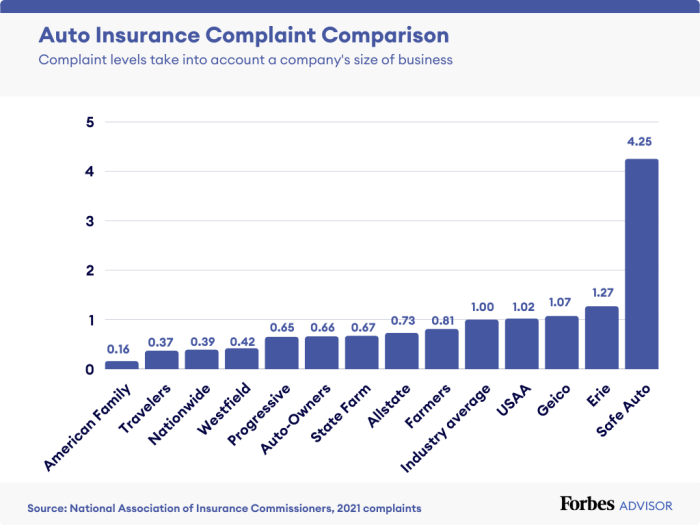

- Geico:Geico offers a variety of monthly payment options, including automatic payments and paperless billing. You can also choose to pay your premium in full or make monthly installments. Geico’s monthly payment plans are designed to be convenient and affordable.

- State Farm:State Farm offers a variety of payment options, including monthly installments. You can also choose to pay your premium in full or make monthly installments. State Farm’s monthly payment plans are designed to be flexible and convenient.

- Progressive:Progressive offers a variety of payment options, including monthly installments. You can also choose to pay your premium in full or make monthly installments. Progressive’s monthly payment plans are designed to be convenient and affordable.

- Allstate:Allstate offers a variety of payment options, including monthly installments. You can also choose to pay your premium in full or make monthly installments. Allstate’s monthly payment plans are designed to be flexible and convenient.

- USAA:USAA offers a variety of payment options, including monthly installments. You can also choose to pay your premium in full or make monthly installments. USAA’s monthly payment plans are designed to be convenient and affordable.

Comparing Monthly Payment Options, Best car insurance providers for people who want to pay monthly

Here is a table comparing the monthly payment options of the top five car insurance providers:

| Provider | Minimum Monthly Payment | Interest Rate | Fees |

|---|---|---|---|

| Geico | $25 | 0% | None |

| State Farm | $30 | 0% | None |

| Progressive | $20 | 0% | None |

| Allstate | $25 | 0% | None |

| USAA | $35 | 0% | None |

Note: These are just examples and may vary depending on your individual circumstances. It’s important to contact the insurance provider directly to get a personalized quote and learn more about their specific monthly payment options.

Factors to Consider When Choosing a Provider

Finding the best car insurance provider for monthly payments isn’t just about the price tag. It’s about finding a plan that fits your individual needs and driving history. This involves evaluating your coverage options, deductibles, and even the reputation of the insurance company.

Individual Needs and Driving History

Your driving history plays a crucial role in determining your insurance rates. A clean driving record with no accidents or violations will typically result in lower premiums. However, if you have a history of accidents or traffic violations, you might face higher premiums.

Additionally, your personal circumstances, such as your age, occupation, and where you live, can influence your insurance costs. For example, young drivers or those living in high-risk areas may face higher premiums due to increased risk.

Coverage Options and Deductibles

Coverage options and deductibles are directly linked to your monthly payments. Choosing a higher deductible means you’ll pay less monthly but more out of pocket if you have an accident. Conversely, a lower deductible means higher monthly payments but less out of pocket in case of an accident.

Consider your financial situation and risk tolerance when selecting your coverage and deductible levels.

Comparing Quotes and Finding the Best Value

Comparing quotes from multiple insurance providers is crucial to finding the best value for your money. You can use online comparison tools or contact insurance agents directly to get quotes.

Make sure to compare apples to apples by ensuring that all quotes include the same coverage options and deductibles.

Look beyond the initial price and consider the provider’s reputation, customer service, and claim handling process.

Tips for Managing Monthly Payments

Paying for car insurance monthly can be a great way to manage your finances, but it’s important to stay on top of your payments to avoid late fees and other penalties. Here are some tips for making sure you’re always on track.

Design a Budget That Incorporates Car Insurance Payments

Creating a budget that includes your car insurance payments will help you understand your overall financial picture and ensure that you have enough money set aside to cover your premiums.

- Start by listing all of your monthly expenses, including rent, utilities, groceries, and any other bills.

- Then, add your car insurance payment to the list.

- Once you have a complete list of your expenses, you can see how much money you have left over each month for other things.

- If you find that you don’t have enough money to cover all of your expenses, you may need to adjust your budget or find ways to cut back on spending.

Tips for Avoiding Late Payments and Potential Penalties

Late payments can lead to penalties and can also negatively impact your credit score.

- Set up automatic payments: This is the easiest way to ensure that your payments are made on time. Most insurance companies offer this option, and you can usually set it up online or over the phone.

- Use a calendar or reminder app: If you prefer to make payments manually, use a calendar or reminder app to set a reminder for when your payment is due.

- Make payments a few days early: This will give you a buffer in case something comes up and you’re unable to make your payment on time.

Review Your Insurance Policy Regularly

It’s important to review your insurance policy regularly to make sure that you’re still getting the best coverage at the best price.

- Check your coverage limits: Make sure that your coverage limits are still adequate for your needs. If you’ve recently purchased a new car or if your financial situation has changed, you may need to increase your coverage limits.

- Compare rates: Shop around for insurance quotes every year to see if you can get a better deal. There are many online comparison websites that can help you do this.

- Consider discounts: Ask your insurance company about any discounts that you may be eligible for, such as discounts for good driving records, safety features, or multiple policies.

Final Conclusion

Finding the best car insurance provider for monthly payments is a bit like choosing your favorite pizza topping – it’s all about finding the perfect combination that fits your needs and budget. By considering your driving history, coverage options, and comparing quotes, you can find the best value for your money and drive with peace of mind.

So, buckle up and get ready to explore the world of car insurance with confidence!

Quick FAQs

What if I miss a monthly payment?

Missing a payment can result in late fees or even cancellation of your policy. It’s important to set reminders and ensure your payment is made on time.

Are there any hidden fees associated with monthly payments?

Some providers may charge a small fee for monthly payments. Make sure to read the fine print and ask about any additional fees before you sign up.

Can I change my payment frequency later?

Yes, most providers allow you to change your payment frequency. You may need to contact them to adjust your plan.