Best car insurance providers for low-income families – Finding affordable car insurance can be a major challenge for low-income families, especially when they’re already juggling tight budgets and essential expenses. It’s not just about finding the cheapest policy; it’s about getting the right coverage that provides adequate protection without breaking the bank.

This guide will explore the best car insurance providers for low-income families, offering insights into key factors to consider, available discounts, and financial assistance programs that can make a big difference.

We’ll delve into the specific needs of low-income families, highlighting the importance of understanding coverage types, deductibles, and premium costs. We’ll also discuss practical tips for saving on car insurance, such as driving safely, maintaining good credit, and exploring alternative payment options.

By understanding these factors and exploring available resources, low-income families can find car insurance that fits their budget and provides peace of mind.

Understanding Financial Constraints of Low-Income Families

Low-income families often face significant financial challenges, making car insurance a considerable expense. Limited income can impact affordability and coverage options, forcing families to make difficult choices between essential needs and insurance.

The Impact of Limited Income on Affordability and Coverage Options

Low-income families may struggle to afford comprehensive car insurance due to limited financial resources. They may have to choose between basic liability coverage, which is the minimum requirement in most states, and more comprehensive coverage that offers greater protection.

- Higher premiums:Low-income families may be considered higher risk by insurance companies due to factors like lower credit scores or lack of driving history, leading to higher premiums.

- Limited coverage options:Families may have to choose between lower coverage limits or higher deductibles to manage premiums.

- Difficulty paying premiums:Irregular income or unexpected expenses can make it challenging to consistently pay premiums on time, leading to potential policy cancellations.

Financial Burdens that Influence Insurance Choices

Families facing financial constraints often have to prioritize essential needs like housing, food, and healthcare over car insurance.

- Medical expenses:Unexpected medical bills can drain financial resources, making it difficult to afford car insurance.

- Housing costs:Rising rent or mortgage payments can leave less disposable income for insurance.

- Debt obligations:Existing debts, like student loans or credit card debt, can strain finances and make insurance affordability a challenge.

Key Factors to Consider for Low-Income Families

Finding the best car insurance for low-income families involves navigating a complex landscape of coverage options, pricing structures, and financial considerations. It’s crucial to understand the unique needs and priorities of families with limited financial resources to make informed decisions that provide adequate protection without breaking the bank.

Coverage Types

Understanding the different types of car insurance coverage is essential for low-income families to ensure they have the right protection in case of an accident.

- Liability Coverage:This is the most basic type of car insurance and is legally required in most states. It covers damages to other people’s property or injuries to others in an accident that you cause. Low-income families should prioritize having sufficient liability coverage to avoid significant financial hardship in case of an accident.

- Collision Coverage:This coverage pays for repairs to your car if you are involved in an accident, regardless of fault. While it’s optional, collision coverage can be beneficial for low-income families, as it can help prevent significant out-of-pocket expenses for repairs.

- Comprehensive Coverage:This coverage protects your car from damage caused by events other than accidents, such as theft, vandalism, or natural disasters. For low-income families, comprehensive coverage can be particularly important if they drive older vehicles that may be more susceptible to these types of damage.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. This is crucial for low-income families, as they are more likely to be involved in accidents with uninsured drivers.

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally mean lower premiums, but they also mean you will have to pay more in case of an accident.

- Low-income families often face financial constraints and may prioritize lower premiums. However, choosing a high deductible can be risky if they cannot afford to pay a large sum out-of-pocket in case of an accident.

- It’s important to strike a balance between affordability and financial protection. Consider your financial situation and determine a deductible you can comfortably afford in case of an unexpected event.

Premium Costs

Car insurance premiums are the monthly or annual payments you make to your insurance company. Factors influencing premium costs include your driving history, age, location, vehicle type, and coverage levels.

- Low-income families may face higher premiums due to factors like driving history or location, as insurers often consider these factors when assessing risk. It’s crucial to shop around and compare quotes from different insurance companies to find the most affordable option.

- Some insurance companies offer discounts for good driving records, safe driving courses, or even bundling your car insurance with other policies, such as homeowners or renters insurance. These discounts can significantly reduce your premium costs.

Discounts and Financial Assistance Programs

Several discounts and financial assistance programs are available to help low-income families afford car insurance.

- Good Driver Discounts:Many insurance companies offer discounts to drivers with clean driving records. Maintaining a safe driving history can significantly reduce your premium costs.

- Low-Mileage Discounts:If you drive your car less frequently, you may qualify for a low-mileage discount. This can be particularly beneficial for low-income families who rely on public transportation or walk to their destinations.

- Safety Feature Discounts:Cars equipped with safety features like anti-theft devices or airbags may qualify for discounts. This can be a good incentive to invest in vehicles with safety features, which can also contribute to overall safety.

- State-Specific Programs:Some states offer financial assistance programs to help low-income families afford car insurance. These programs may provide subsidies or discounts to eligible individuals. It’s essential to research available programs in your state and see if you qualify.

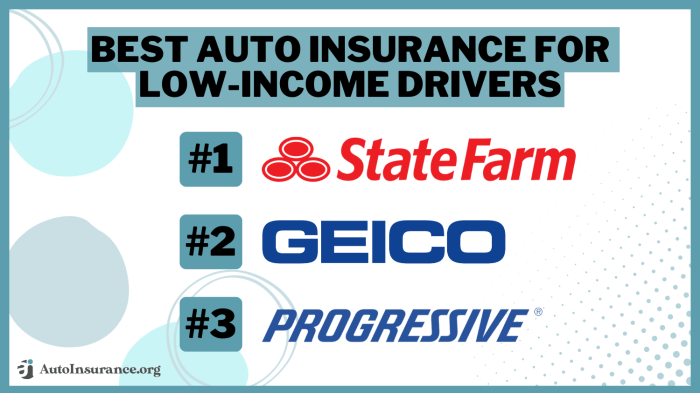

Top Car Insurance Providers for Low-Income Families

Finding affordable car insurance can be challenging, especially for low-income families. Fortunately, several insurance providers cater to this demographic, offering competitive rates and flexible payment options. Here’s a breakdown of some top contenders:

Top Car Insurance Providers for Low-Income Families, Best car insurance providers for low-income families

Many insurance providers offer affordable options for low-income families, but some stand out for their commitment to accessibility and affordability. These providers often prioritize customer service, financial flexibility, and community engagement, making them excellent choices for those seeking budget-friendly coverage.

| Provider Name | Coverage Types | Average Premiums | Available Discounts |

|---|---|---|---|

| Geico | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist | $1,000

|

Good Driver, Multi-Car, Multi-Policy, Defensive Driving, Military, Good Student |

| Progressive | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Rental Reimbursement | $1,200

|

Good Driver, Multi-Car, Multi-Policy, Safe Driver, Homeowner, Paperless Billing |

| State Farm | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | $1,100

|

Good Driver, Multi-Car, Multi-Policy, Safe Driver, Homeowner, Drive Safe & Save |

| Nationwide | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Roadside Assistance | $1,000

|

Good Driver, Multi-Car, Multi-Policy, Safe Driver, Homeowner, Student Discount |

Geico:Geico is known for its competitive rates and comprehensive coverage options. They offer a wide range of discounts, including those for good drivers, multi-car policies, and military service. Their online quoting process and 24/7 customer support make them a convenient choice for budget-conscious drivers.

Progressive:Progressive stands out for its personalized insurance options and innovative features like their “Name Your Price” tool. They offer a variety of discounts, including those for safe drivers, multi-car policies, and homeownership. Their focus on customer satisfaction and technology-driven solutions makes them a popular choice for many.

State Farm:State Farm is a trusted name in the insurance industry, known for its reliable coverage and strong customer service. They offer a range of discounts, including those for good drivers, safe drivers, and homeownership. Their commitment to community engagement and financial stability makes them a reliable option for families seeking peace of mind.

Nationwide:Nationwide offers comprehensive coverage and a wide range of discounts, including those for good drivers, multi-car policies, and students. They are known for their strong financial standing and commitment to customer satisfaction. Their focus on personalized service and a variety of coverage options makes them a good choice for families seeking flexibility.

Evaluating Coverage Options: Best Car Insurance Providers For Low-income Families

Choosing the right car insurance coverage is crucial for low-income families. It’s important to find a balance between affordable premiums and adequate protection. This section explores different coverage types and their relevance to low-income families.

Comparison of Coverage Options

Different types of car insurance coverage provide different levels of protection. Here’s a comparison of common coverage options:

| Coverage Type | Description | Benefits for Low-Income Families | Drawbacks for Low-Income Families |

|---|---|---|---|

| Liability Coverage | Covers damage to other people’s property or injuries to other people caused by you in an accident. | Essential for legal protection and financial security in case of an accident. | May be expensive if you need high limits to cover potential liabilities. |

| Collision Coverage | Covers damage to your car if you’re involved in an accident, regardless of fault. | Provides financial assistance to repair or replace your car. | Can be costly, especially for newer or more expensive vehicles. |

| Comprehensive Coverage | Covers damage to your car from non-collision events, such as theft, vandalism, or natural disasters. | Protects against unexpected financial burdens from non-collision incidents. | May not be necessary if your car is older or has low value. |

| Uninsured/Underinsured Motorist Coverage | Covers your injuries and property damage if you’re hit by a driver without insurance or insufficient coverage. | Crucial for protection against drivers who cannot afford to cover your losses. | Can be expensive but provides essential protection. |

| Medical Payments Coverage (Med Pay) | Covers medical expenses for you and your passengers, regardless of fault. | Provides immediate financial assistance for medical bills after an accident. | May overlap with health insurance, potentially leading to unnecessary expenses. |

Benefits and Drawbacks of Coverage Options

- Liability Coverage:This is the most essential type of coverage, as it protects you from legal and financial repercussions in case you cause an accident. It’s generally mandatory in most states, and you’ll likely need it to comply with state laws.

However, if you have an older car with a lower value, you might be able to reduce your liability limits to lower your premium. This is a common strategy for low-income families who prioritize affordability.

- Collision Coverage:Collision coverage is helpful for newer or more expensive vehicles, as it covers repairs or replacement after an accident. For older cars, it might be more cost-effective to decline collision coverage and self-insure, meaning you would be responsible for the cost of repairs.

- Comprehensive Coverage:Comprehensive coverage protects against non-collision events, like theft or vandalism. If you have an older car with a lower value, it might not be worth the cost of comprehensive coverage. However, if your car is financed or leased, your lender may require you to maintain comprehensive coverage.

- Uninsured/Underinsured Motorist Coverage:This coverage is crucial, especially in areas with a high number of uninsured drivers. It provides protection if you’re hit by a driver who doesn’t have insurance or enough coverage to cover your losses. Even if you have a low-value car, it’s essential to have this coverage, as it can protect you from significant financial hardship.

- Medical Payments Coverage (Med Pay):Med Pay coverage provides immediate financial assistance for medical bills after an accident, regardless of fault. While it can be helpful, it’s important to consider your existing health insurance coverage. If you have comprehensive health insurance, Med Pay coverage might be redundant and unnecessary.

Discounts and Financial Assistance

Finding affordable car insurance can be a challenge for low-income families. However, there are several discounts and financial assistance programs available to help make insurance more accessible. These programs can help families save money on their premiums and ensure they have the coverage they need.

Common Car Insurance Discounts

Many insurance companies offer discounts to policyholders who meet certain criteria. These discounts can significantly reduce premiums, making insurance more affordable.

- Good Driver Discount:This discount is typically awarded to drivers with a clean driving record, meaning they have not been involved in any accidents or received traffic violations within a specified period.

- Safe Driver Discount:Similar to the good driver discount, this discount rewards drivers who have completed a defensive driving course or demonstrated safe driving habits.

- Multi-Car Discount:Insurance companies often offer a discount if you insure multiple vehicles with them.

- Multi-Policy Discount:This discount applies if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, with the same company.

- Low Mileage Discount:If you drive less than the average driver, you may qualify for a low mileage discount.

- Good Student Discount:Some insurance companies offer a discount to students who maintain a certain grade point average.

- Anti-theft Device Discount:Installing anti-theft devices in your car can lower your premium.

- Payment Plan Discount:Paying your premium in full or choosing an annual payment plan can sometimes result in a discount.

Financial Assistance Programs

Several financial assistance programs are available to help low-income families afford car insurance.

- Low-Income Auto Insurance Programs:Some states offer low-income auto insurance programs, often subsidized by the government, that provide affordable coverage to qualifying individuals.

- Community Outreach Initiatives:Many community organizations offer financial assistance programs to help families pay for car insurance. These programs may be funded by donations, grants, or other sources.

- Government Subsidies:In some cases, the government may provide subsidies to help low-income families afford car insurance.

Tips for Saving on Car Insurance

Finding affordable car insurance is a priority for low-income families. There are several strategies you can employ to lower your premiums and ensure you have the coverage you need without breaking the bank.

Driving Safely

Maintaining a clean driving record is crucial for keeping your insurance premiums low. Insurance companies view safe drivers as less risky, leading to lower rates. Here are some tips to help you achieve this:

- Avoid Traffic Violations:Speeding tickets, reckless driving, and DUI offenses can significantly increase your insurance costs.

- Practice Defensive Driving:Learning defensive driving techniques can help you avoid accidents and stay safe on the road.

- Maintain a Safe Driving History:Avoid driving while distracted, tired, or under the influence of alcohol or drugs.

Maintaining Good Credit

Believe it or not, your credit score can impact your car insurance rates. Insurance companies often use your credit score to assess your financial responsibility, which they consider a reflection of your driving habits. Here are some ways to improve your credit score:

- Pay Bills on Time:Late payments can negatively affect your credit score. Make sure to pay all your bills, including utilities, credit cards, and loans, on time.

- Keep Credit Utilization Low:Aim to keep your credit utilization ratio below 30%. This means using less than 30% of your available credit.

- Monitor Your Credit Report:Check your credit report regularly for any errors or inconsistencies.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts for customers who bundle multiple policies.

- Homeowners or Renters Insurance:Bundling your car insurance with homeowners or renters insurance is a common way to save money.

- Life Insurance:Some insurance companies offer discounts for bundling car insurance with life insurance policies.

Negotiating with Insurance Providers

Don’t be afraid to negotiate with your insurance provider to try to get a better rate. Here are some strategies:

- Shop Around:Get quotes from multiple insurance companies to compare rates and coverage options.

- Highlight Your Safe Driving Record:Emphasize your clean driving history to demonstrate your low-risk status.

- Ask About Discounts:Inquire about available discounts, such as those for good students, safe drivers, or multiple policyholders.

Exploring Alternative Payment Options

Some insurance companies offer alternative payment options that can make it easier for low-income families to manage their premiums.

- Payment Plans:Some insurance companies allow you to pay your premium in installments rather than a lump sum.

- Low-Down Payment Options:Consider insurance companies that offer low-down payment options to help you get started.

Closure

Finding the right car insurance for low-income families is a balancing act between affordability and adequate coverage. By understanding the factors that matter most, exploring available discounts and financial assistance programs, and implementing practical savings strategies, families can find the best insurance solution to fit their unique needs and financial situation.

Remember, it’s important to shop around, compare quotes, and choose a provider that offers the best value for your money, ensuring you have the protection you need without breaking the bank.

Quick FAQs

What if I can’t afford car insurance?

There are options! Many states have programs that help low-income families afford car insurance. Contact your state’s insurance department to learn more.

How can I get the best discounts on car insurance?

Ask about discounts for safe driving, good credit, bundling policies, and other factors. You can also consider taking a defensive driving course.

What if I need to file a claim?

Make sure you understand your policy’s coverage and how to file a claim. Keep detailed records of all incidents and communications with your insurance provider.