How much does car insurance cost in California? It’s a question many residents ask themselves, and the answer is not simple. Car insurance premiums are influenced by a variety of factors, from your driving record to the type of car you drive, and California has its own unique set of laws and regulations that impact costs.

This guide will explore the key factors that affect car insurance prices in the Golden State, providing insights into how to find the best rates and potentially save money.

We’ll break down the factors that influence car insurance costs, including your age, driving history, credit score, the type of vehicle you drive, your location, and the coverage you choose. We’ll also delve into California’s specific insurance laws and regulations, comparing the state’s market to others.

Finally, we’ll provide tips on how to get quotes, compare rates, and potentially lower your premiums.

Factors Influencing Car Insurance Costs

Several factors determine how much you pay for car insurance in California. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Insurance companies generally consider younger drivers to be riskier due to their lack of experience. This is why younger drivers often pay higher premiums. As you age and gain more driving experience, your premiums typically decrease. This is because you are considered a lower risk to insurance companies.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. Drivers with a clean driving record, without accidents or traffic violations, are considered less risky and usually receive lower rates. On the other hand, drivers with a history of accidents, speeding tickets, or DUI convictions are seen as higher risks and may face higher premiums.

Credit Score

In California, insurance companies can use your credit score to assess your risk as a driver. A higher credit score generally indicates a lower risk and can lead to lower premiums. This is because a good credit score often reflects responsible financial behavior, which can be correlated with responsible driving habits.

Vehicle Type, Make, and Model

The type, make, and model of your car can significantly impact your insurance costs. For example, luxury cars, sports cars, and vehicles with high-performance engines are often more expensive to repair and replace. This higher repair cost translates to higher insurance premiums.

Additionally, vehicles with safety features like anti-lock brakes and airbags can lead to lower premiums.

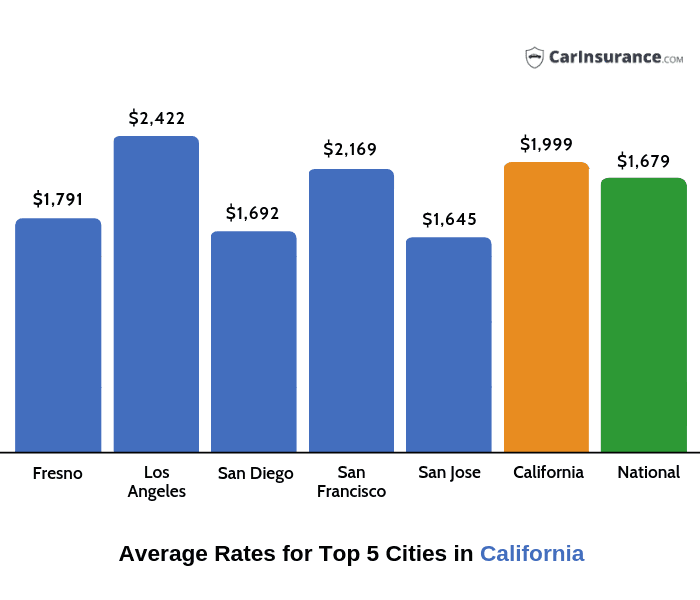

Location

Your location in California can also affect your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequencies tend to have higher premiums. Insurance companies consider these factors because they increase the likelihood of accidents and claims.

Driving Distance

The amount you drive can influence your car insurance premiums. Drivers who drive fewer miles generally pay lower premiums. This is because they have a lower risk of getting into an accident. If you drive a significant amount for work or other purposes, you might be considered a higher risk and face higher premiums.

Coverage Types

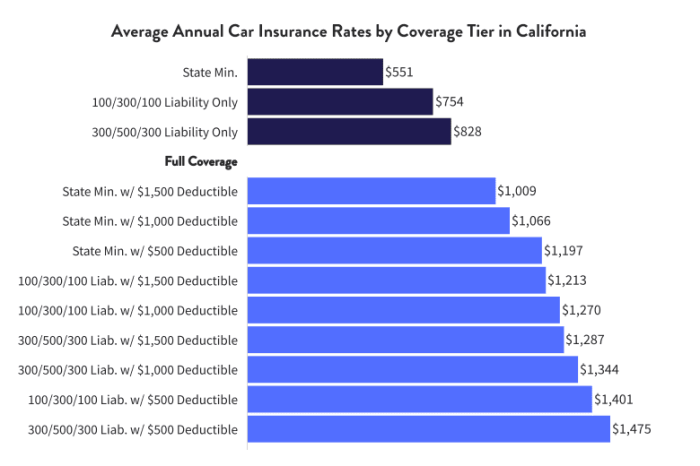

The type of coverage you choose for your car insurance policy will directly affect your premiums. Here are some common coverage types and their impact on costs:

- Liability Coverage:This coverage is required by law in California and protects you financially if you cause an accident that injures someone or damages their property. The higher your liability limits, the more expensive your insurance will be, but you’ll have more financial protection.

- Collision Coverage:This coverage pays for repairs or replacement of your car if you’re involved in an accident, regardless of who is at fault. Collision coverage is optional but can be essential if you have a loan or lease on your car.

- Comprehensive Coverage:This coverage protects you from damages to your car caused by events other than accidents, such as theft, vandalism, or natural disasters. Comprehensive coverage is also optional but can be beneficial if you have a newer or more expensive vehicle.

California-Specific Regulations and Laws

California has a unique set of regulations and laws that significantly impact car insurance costs. These regulations aim to ensure fair pricing and protect consumers, but they can also make insurance more expensive compared to other states.

Mandatory Insurance Requirements

California law requires all drivers to have at least the following types of insurance:

- Liability Coverage:This covers damages to other people’s property or injuries to others in an accident caused by you. The minimum requirements are $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage.

- Uninsured Motorist Coverage:This protects you and your passengers if you are injured in an accident caused by an uninsured or hit-and-run driver. The minimum requirement is $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage.

These mandatory insurance requirements increase the cost of car insurance in California, as insurance companies must factor in the risk of covering claims from uninsured drivers.

Role of the California Department of Insurance, How much does car insurance cost in California?

The California Department of Insurance (CDI) plays a crucial role in regulating car insurance rates. The CDI has the authority to:

- Approve or reject rate increases proposed by insurance companies:The CDI reviews rate increases to ensure they are justified by factors like rising claims costs or increased risk. This helps to prevent insurers from charging excessive premiums.

- Investigate complaints against insurance companies:The CDI investigates complaints from consumers regarding insurance practices, including unfair rate increases or denial of claims. This helps to ensure fair treatment for policyholders.

- Promote competition among insurance companies:The CDI encourages competition in the insurance market by making it easier for new companies to enter the state and by monitoring existing companies to prevent unfair practices.

Unique California Laws and Regulations

California has several unique laws and regulations that influence car insurance costs. These include:

- The California Automobile Assigned Risk Plan (CAARP):This plan provides insurance to high-risk drivers who cannot obtain coverage through the traditional market. This program helps to ensure that all drivers have access to insurance, but it also increases costs for all policyholders as they contribute to the program through their premiums.

- The California Fair Plan Association:This association provides insurance to drivers who have been denied coverage by traditional insurance companies due to factors like a poor driving record or a high-risk vehicle. Similar to CAARP, this plan also contributes to higher insurance costs for everyone.

- The California Insurance Guarantee Association (CIGA):This association protects policyholders in the event that an insurance company becomes insolvent. This program helps to ensure that policyholders do not lose their coverage, but it also increases costs for all policyholders as they contribute to the program through their premiums.

Comparison with Other States

California’s car insurance market is generally more expensive than in other states. This is due to several factors, including:

- Higher population density:California has a high population density, leading to more vehicles on the road and a greater risk of accidents.

- Higher cost of living:The cost of living in California is generally higher than in other states, which can lead to higher claim costs for insurance companies.

- Stricter regulations:California’s strict regulations on insurance pricing and consumer protection can lead to higher costs for insurers, which are then passed on to policyholders.

Getting Quotes and Comparing Rates

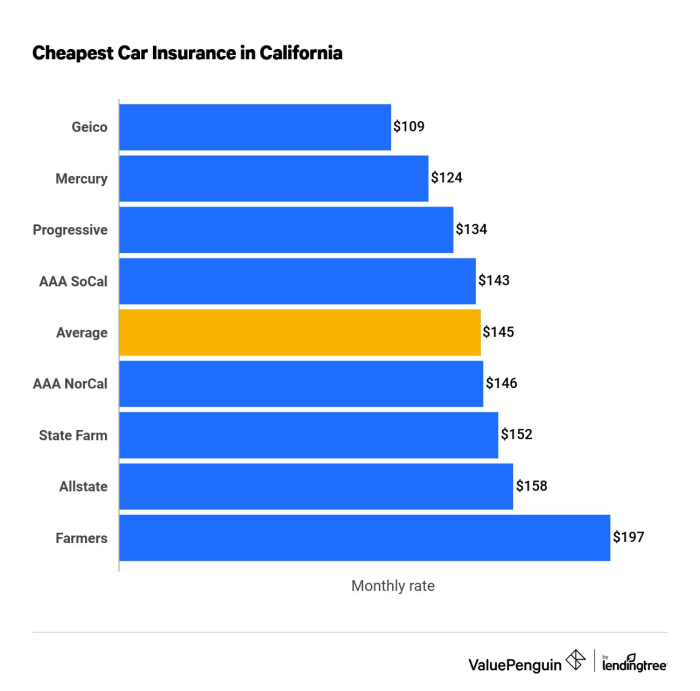

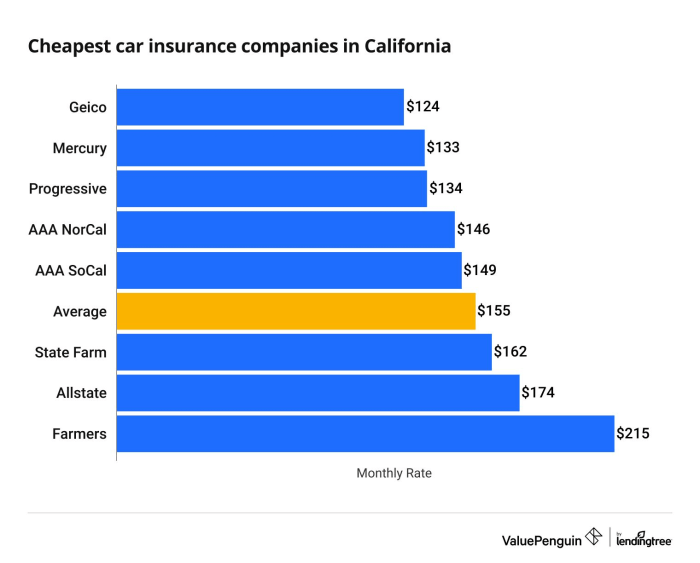

Finding the right car insurance policy in California involves more than just picking the first quote you see. You’ll want to shop around and compare rates from different insurers to ensure you’re getting the best deal.

Getting Quotes

Getting quotes from different car insurance companies is straightforward. Most insurers have online quote tools, making the process quick and convenient. Here’s a step-by-step guide:

- Gather your information.Before you start, gather all the necessary information, including your driver’s license number, vehicle information (make, model, year), and any relevant details about your driving history, such as accidents or violations.

- Visit insurer websites.Go to the websites of different car insurance companies and use their online quote tools. These tools will ask for your information and provide you with a personalized quote.

- Contact insurance agents.If you prefer a more personal approach, you can contact insurance agents directly. They can provide you with quotes and answer any questions you may have.

- Consider using comparison websites.Websites like [insert relevant comparison websites here] allow you to compare quotes from multiple insurers simultaneously. These websites can save you time and effort.

Comparing Quotes

Once you have several quotes, it’s crucial to compare them carefully. Don’t just focus on the price. Consider the following factors:

- Coverage.Make sure the coverage offered by each insurer meets your needs. Don’t settle for the cheapest policy if it doesn’t provide enough protection.

- Deductibles.A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles usually mean lower premiums, but you’ll have to pay more if you file a claim.

- Discounts.Many insurers offer discounts for good driving records, safety features in your car, or bundling your car insurance with other policies like homeowners or renters insurance.

- Customer service.Read reviews or ask friends and family about their experiences with different insurers. You want to choose a company with a good reputation for customer service.

Using Online Comparison Tools

Online comparison tools are a great way to quickly get quotes from multiple insurers. These tools work by collecting your information and then sending it to different insurance companies. You’ll receive quotes within minutes, allowing you to compare them side-by-side.

Negotiating with Insurance Companies

While online tools are convenient, you can also negotiate with insurance companies to try and lower your premiums. Here are some tips:

- Shop around.Get quotes from multiple insurers and use them as leverage during negotiations.

- Highlight your good driving record.If you have a clean driving history, emphasize this to the insurer.

- Ask about discounts.Inquire about available discounts, such as those for good students, safe drivers, or multiple policies.

- Consider increasing your deductible.A higher deductible can lead to lower premiums.

- Be polite and persistent.Don’t be afraid to negotiate. Insurance companies are often willing to work with you to find a solution that works for both parties.

Tips for Saving on Car Insurance

Car insurance is a necessity for most Californians, but it can be a significant expense. Fortunately, there are a number of strategies you can use to lower your premiums. By understanding these strategies and implementing them effectively, you can save money on your car insurance without compromising coverage.

Strategies for Reducing Car Insurance Costs

- Bundle your policies. Combining your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in a discount.

- Maintain a good driving record. Your driving history is a major factor in determining your insurance rates. Avoiding accidents, traffic violations, and DUI convictions can significantly lower your premiums.

- Increase your deductibles. A deductible is the amount you pay out of pocket before your insurance kicks in. Increasing your deductible can lower your premium, but you will have to pay more in the event of a claim.

- Shop around for quotes. Different insurance companies offer varying rates, so it’s essential to compare quotes from multiple companies to find the best deal.

- Take advantage of discounts. Many insurance companies offer discounts for things like safe driving, good student status, and having multiple cars insured with them.

Strategies for Saving on Car Insurance: A Detailed Look

Here is a table outlining various strategies to reduce your car insurance costs, along with their potential savings and considerations:

| Strategy | Description | Potential Savings | Considerations |

|---|---|---|---|

| Bundling Policies | Combining your car insurance with other insurance policies like homeowners or renters insurance. | Up to 20% discount on your premium. | Ensure you’re comparing apples to apples when comparing bundled vs. separate policies. |

| Maintaining a Good Driving Record | Avoiding accidents, traffic violations, and DUI convictions. | Significant reduction in premium, depending on the severity of your driving history. | This strategy requires consistent safe driving practices and can take time to see its full impact. |

| Increasing Deductibles | Raising the amount you pay out of pocket before your insurance kicks in. | Lower premiums, but higher out-of-pocket expenses in case of an accident. | Assess your financial situation and risk tolerance before increasing your deductible. |

| Shopping Around for Quotes | Comparing rates from different insurance companies. | Potentially significant savings, as rates can vary significantly between companies. | Take the time to gather quotes from multiple companies and compare their coverage options. |

| Taking Advantage of Discounts | Qualifying for discounts based on factors like safe driving, good student status, and multi-car insurance. | Discounts vary depending on the company and the specific discount offered. | Ensure you meet the eligibility criteria for each discount and inquire about specific requirements. |

Impact of Driving Habits and Safety Features on Insurance Premiums

Driving habits and safety features can significantly impact your insurance premiums. Safe driving practices, such as avoiding speeding, aggressive driving, and distracted driving, can lead to lower premiums. Similarly, vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and lane departure warning systems, are often associated with lower insurance costs.

[Image: A visual representation showing a car with a speedometer needle pointing to a safe speed, a green checkmark for a good driving record, and a car with advanced safety features like airbags and lane departure warning system. The image could also include a bar graph illustrating how safe driving habits and safety features can lead to lower premiums.]

Discounts Available to California Drivers

California insurance companies offer a variety of discounts to drivers. Some common discounts include:

- Safe driver discount: Awarded to drivers with a clean driving record, demonstrating safe driving habits.

- Good student discount: Available to students with good grades, indicating responsible behavior and lower risk.

- Multi-car discount: Offered to drivers who insure multiple vehicles with the same company.

- Other discounts: Companies may offer additional discounts for factors like vehicle safety features, anti-theft devices, and membership in certain organizations.

Final Wrap-Up: How Much Does Car Insurance Cost In California?

Navigating the world of car insurance in California can feel overwhelming, but by understanding the factors that affect your premiums and using the resources available to you, you can find the best coverage at a price that fits your budget.

Whether you’re a new driver or a seasoned veteran, this guide provides the information you need to make informed decisions about your car insurance.

Essential FAQs

What are the minimum car insurance requirements in California?

California requires all drivers to carry liability insurance, which covers damages to other people and their property in an accident. The minimum limits are $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage.

How often can I expect my car insurance rates to change?

Car insurance rates can change periodically, typically on your policy renewal date. They may be adjusted based on factors like your driving record, changes in your vehicle, or fluctuations in the insurance market.

Is it worth it to bundle my car and homeowners insurance?

Yes, bundling your car and homeowners insurance with the same company can often lead to significant discounts on your premiums. It’s a great way to save money on your insurance costs.