How to find affordable car insurance for a family of four is a question that many parents grapple with. Juggling the needs of a growing family while keeping insurance costs in check can feel like a tightrope walk. But don’t worry, you’re not alone.

With some strategic planning and a bit of research, you can find a policy that fits your budget and protects your loved ones.

This guide will walk you through the process of finding the best car insurance for your family, covering everything from understanding your needs to negotiating the best rates. We’ll explore different types of policies, highlight key considerations, and reveal the secrets to securing discounts and saving money.

Understanding Family Car Insurance Needs: How To Find Affordable Car Insurance For A Family Of Four

You’ve already tackled the basics of car insurance, but when you’re insuring a family, there are more factors to consider. Let’s dive into the things that can affect your family’s car insurance costs and how to make smart choices for your specific needs.

Factors Influencing Family Car Insurance Costs

Your family’s car insurance premiums are influenced by a variety of factors. Understanding these factors will help you make informed decisions and potentially save money.

- Number of Drivers:The more drivers you have, the more likely your insurance company will assume you’ll be on the road more often. This can increase your premiums.

- Driving History:Each driver’s driving history, including accidents, tickets, and violations, significantly impacts your rates. A clean record usually translates to lower premiums.

- Age and Gender:Younger and inexperienced drivers are statistically more likely to be involved in accidents, leading to higher premiums. Gender also plays a role, with some insurers considering men to be higher-risk drivers.

- Vehicle Type:The type of car you drive influences your insurance costs. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and potential for theft.

- Location:Where you live impacts your insurance rates. Areas with high crime rates or heavy traffic tend to have higher premiums.

- Credit Score:Surprisingly, your credit score can influence your car insurance rates. Insurers use credit score as a proxy for risk, believing that people with good credit are more responsible and less likely to file claims.

Exploring Affordable Car Insurance Options

Finding affordable car insurance for a family of four can be a real challenge. It’s important to shop around and compare quotes from different insurance companies to find the best deal. You should also consider the different types of car insurance policies available and their respective benefits and drawbacks.

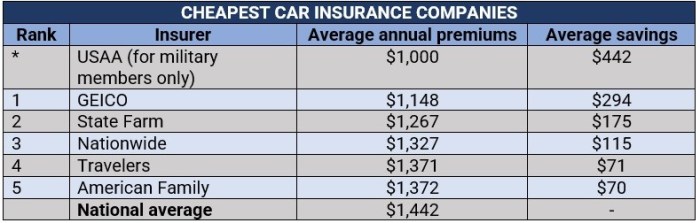

Comparing Car Insurance Companies

Choosing the right car insurance company can significantly impact your premiums. Some companies are known for offering competitive rates, while others may specialize in specific types of coverage. Here are a few car insurance companies that are often cited for their affordable rates:

- Geico

- Progressive

- State Farm

- USAA

- Nationwide

It’s important to note that these are just a few examples, and the best company for you will depend on your individual needs and circumstances. It’s always a good idea to get quotes from multiple companies and compare their coverage options and rates.

Comparing Car Insurance Policies

Different types of car insurance policies offer varying levels of coverage and protection. Understanding the differences between these policies can help you choose the best option for your family.Here are some common types of car insurance policies:

- Liability Insurance: This is the most basic type of car insurance, and it covers damages to other people’s property or injuries to other people if you cause an accident. It’s typically required by law in most states.

- Collision Coverage: This coverage pays for repairs to your car if you’re involved in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage pays for repairs to your car if it’s damaged in an event other than an accident, such as theft, vandalism, or a natural disaster.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other expenses if you’re injured in an accident, regardless of who’s at fault.

Benefits and Drawbacks of Car Insurance Policies, How to find affordable car insurance for a family of four

The best car insurance policy for your family will depend on your individual needs and risk tolerance. It’s important to weigh the benefits and drawbacks of each policy type before making a decision.Here’s a breakdown of the benefits and drawbacks of some common car insurance policies:

| Policy Type | Benefits | Drawbacks |

|---|---|---|

| Liability Insurance | – Meets minimum legal requirements.

|

– Does not cover your own vehicle damage.

|

| Collision Coverage | – Covers repairs to your vehicle after an accident.

|

– Can be expensive, especially for newer cars.

|

| Comprehensive Coverage | – Covers damage to your vehicle from events other than accidents.

|

– Can be expensive, especially if you live in an area prone to natural disasters.

|

| Uninsured/Underinsured Motorist Coverage | – Protects you if you’re involved in an accident with an uninsured or underinsured driver.

|

– Can be expensive, especially if you live in an area with a high rate of uninsured drivers.

|

| Personal Injury Protection (PIP) | – Covers medical expenses and lost wages after an accident.

|

– Can be expensive, especially if you live in a state with high medical costs.

|

Ultimate Conclusion

Finding affordable car insurance for a family of four doesn’t have to be a stressful endeavor. By taking the time to understand your needs, comparing different options, and utilizing available resources, you can secure a policy that provides peace of mind and fits your budget.

Remember, your family’s safety is paramount, and with the right approach, you can find the perfect balance between affordability and comprehensive coverage.

FAQ

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or even more frequently if you experience major life changes like getting married, having a child, or buying a new car.

What are the common types of car insurance coverage?

Common types of car insurance coverage include liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each type provides different levels of protection in case of an accident.

What are some ways to reduce my car insurance premium?

Some ways to reduce your car insurance premium include maintaining a good driving record, bundling your car insurance with other policies, taking a defensive driving course, and installing safety features in your car.

What should I do if I’m not satisfied with my current car insurance provider?

If you’re not satisfied with your current car insurance provider, you can always shop around for a new one. Use online comparison websites to get quotes from different companies and find the best rates.