What are the benefits of having homeowners insurance? It’s a question many homeowners ask themselves, especially when considering the cost of a policy. But the truth is, homeowners insurance provides a safety net that can protect your biggest investment – your home.

It’s not just about covering the cost of repairs after a fire or theft, it’s about peace of mind knowing you’re financially protected from the unexpected.

Think about it this way: homeowners insurance is like a safety net for your home. It protects you from the financial fallout of unexpected events, like a fire, theft, or natural disaster. It also offers liability coverage, which protects you from lawsuits if someone gets hurt on your property.

And with additional coverage options, you can tailor your policy to meet your specific needs.

Financial Protection

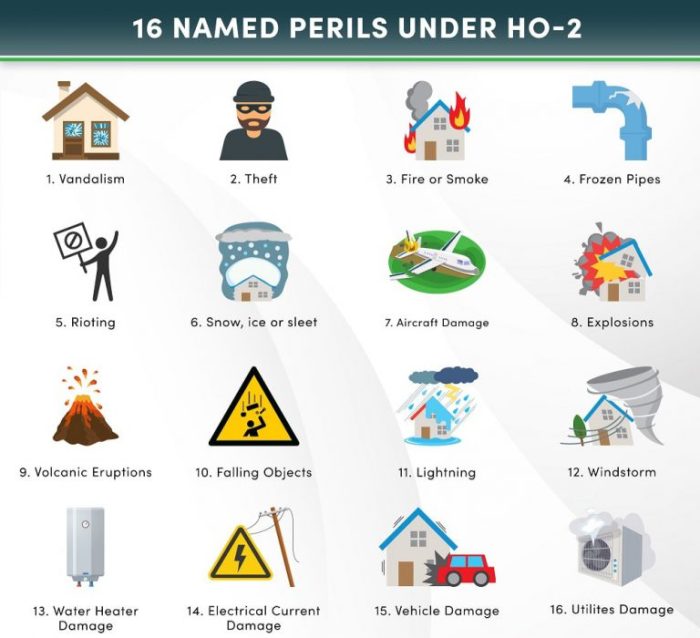

Homeowners insurance is your financial safety net when unexpected events strike. It acts as a shield, protecting you from significant financial losses due to covered perils like fire, theft, and natural disasters. By providing financial compensation, homeowners insurance helps you rebuild your life and recover from these unfortunate events.

Coverage Limits and Deductibles

Homeowners insurance policies come with coverage limits, which represent the maximum amount your insurer will pay for covered losses. These limits are typically set per occurrence, meaning they apply to a single event like a fire or a hailstorm. Additionally, every policy has a deductible, which is the amount you pay out-of-pocket before your insurance kicks in.

The higher your deductible, the lower your premium will be.

For example, if you have a $100,000 coverage limit and a $1,000 deductible, and your home sustains $50,000 in damages from a fire, your insurance company will pay $49,000 (coverage limit minus deductible). You would be responsible for the remaining $1,000.

Scenarios Where Homeowners Insurance Covers Repair or Replacement Costs

Here are some examples of situations where homeowners insurance would cover repair or replacement costs:

- Fire Damage:A fire caused by faulty wiring or a lightning strike damages your kitchen, destroying cabinets, appliances, and flooring. Your homeowners insurance would cover the cost of repairing or replacing these items.

- Theft:Someone breaks into your home and steals valuable electronics, jewelry, and other personal belongings. Homeowners insurance would cover the cost of replacing these stolen items, up to the policy’s limits.

- Windstorm Damage:A strong windstorm rips off part of your roof, causing significant water damage to the interior of your home. Your homeowners insurance would cover the cost of repairing or replacing the roof and fixing the water damage.

- Natural Disasters:A hurricane, tornado, or earthquake causes extensive damage to your home. Homeowners insurance would cover the cost of repairing or rebuilding your home, depending on the policy’s coverage and limits.

Liability Coverage

Liability coverage is a crucial part of homeowners insurance that protects you from financial ruin if someone gets hurt or their property is damaged on your property. This coverage helps pay for legal defense, medical bills, and property repairs.

It’s like having a safety net to catch you if something goes wrong.

Types of Liability Coverage

Homeowners insurance policies typically offer several types of liability coverage, each designed to protect you in different situations.

- Personal Liability Coverage:This is the most common type of liability coverage, protecting you from claims arising from bodily injury or property damage caused by you, a family member, or even your pet. It covers things like a guest tripping on your porch and breaking their leg, your dog biting a neighbor, or your child accidentally damaging a neighbor’s fence.

- Medical Payments Coverage:This coverage pays for medical expenses for anyone injured on your property, regardless of who is at fault. This can help avoid lawsuits, even if you weren’t responsible for the injury. For example, if a delivery person slips on your icy sidewalk and gets hurt, this coverage would help pay for their medical bills.

- Umbrella Liability Coverage:This coverage acts as an extra layer of protection, providing additional liability insurance on top of your existing homeowners policy. It can cover you for claims that exceed the limits of your basic liability coverage. This is especially important if you have a high net worth or own valuable assets.

How Liability Coverage Protects Homeowners

Liability coverage acts as a shield, protecting you from the financial burden of lawsuits and claims. If someone sues you for damages caused on your property, your liability coverage will:

- Pay for Legal Defense:Your insurance company will hire a lawyer to defend you in court, helping you navigate the legal process and protect your interests.

- Cover Medical Expenses:If someone is injured on your property, your liability coverage will help pay for their medical bills, including doctor visits, hospital stays, and medications.

- Pay for Property Damage:If you or someone on your property accidentally damages someone else’s property, your liability coverage will help pay for repairs or replacement costs.

Examples of Liability Coverage, What are the benefits of having homeowners insurance

Here are some real-world examples of situations where liability coverage would be essential:

- A Guest Slips and Falls:A friend visits your home, slips on a wet floor, and breaks their arm. Your liability coverage will help pay for their medical expenses and any legal fees if they decide to sue you.

- Your Dog Bites a Neighbor:Your dog escapes from your yard and bites a neighbor. Your liability coverage will help pay for the neighbor’s medical bills and any legal fees if they decide to sue you.

- A Tree Falls on Your Neighbor’s House:A storm causes a tree in your yard to fall on your neighbor’s house, causing significant damage. Your liability coverage will help pay for the repairs to your neighbor’s house.

- A Child Damages a Neighbor’s Car:Your child is playing in the driveway and accidentally throws a ball that hits your neighbor’s car, causing a dent. Your liability coverage will help pay for the repairs to your neighbor’s car.

Final Conclusion: What Are The Benefits Of Having Homeowners Insurance

Homeowners insurance is more than just a policy – it’s a commitment to protecting your home and your future. It provides financial security, peace of mind, and the assurance that you’ll be able to rebuild your life if the unexpected happens.

So, before you dismiss the idea of homeowners insurance as an unnecessary expense, consider the peace of mind and financial protection it offers. It might be the best investment you ever make.

Essential FAQs

What is the difference between homeowners insurance and renters insurance?

Homeowners insurance covers the structure of your home, while renters insurance covers your personal belongings.

How much homeowners insurance do I need?

The amount of homeowners insurance you need depends on the value of your home and the amount of coverage you want.

What is a deductible?

A deductible is the amount you pay out of pocket before your homeowners insurance policy starts to cover claims.