What are the best car insurance companies for seniors? Navigating the world of car insurance can be a bit overwhelming, especially as you enter your golden years. You might be driving less, but you’re still on the road, and you need to make sure you’re protected.

But don’t worry, we’re here to break it down and help you find the best fit for your needs.

As a senior driver, you have unique considerations. Maybe you’re worried about higher premiums due to your age. Or maybe you’re looking for discounts specific to seniors. Whatever your concerns, there are companies out there that understand your needs and offer competitive rates and valuable benefits.

We’ll guide you through the process of finding the perfect policy that gives you peace of mind on the road.

Understanding Senior Car Insurance Needs

As you age, your driving habits and needs may change. It’s important to understand these changes and how they affect your car insurance. Seniors often face unique challenges when it comes to car insurance, and understanding these nuances can help you find the best coverage at the best price.

Senior Driving Habits and Risk Factors, What are the best car insurance companies for seniors

Seniors often have different driving habits and risk factors compared to younger drivers. For instance, they may drive less frequently, but when they do drive, they may be more likely to be involved in an accident due to factors like slower reaction times or diminished vision.

- Reduced Driving Frequency:Seniors often drive less frequently than younger drivers. This can be due to retirement, health issues, or a shift in lifestyle. However, it’s important to remember that driving less doesn’t necessarily mean driving safer.

- Increased Risk of Accidents:Seniors may be more likely to be involved in an accident due to factors like slower reaction times, diminished vision, and age-related health conditions. However, studies have shown that seniors with good health and driving habits have accident rates similar to younger drivers.

- Potential for Higher Insurance Premiums:Insurance companies may perceive seniors as a higher risk due to these factors. However, many insurance companies offer discounts for seniors who take defensive driving courses or have good driving records.

Senior Concerns Regarding Car Insurance

Seniors often have specific concerns about car insurance, such as affordability, coverage, and access to discounts.

- Affordability:Seniors may be on a fixed income and may need to find ways to keep their car insurance costs down. Many insurance companies offer discounts for seniors who meet certain criteria, such as being accident-free or taking a defensive driving course.

- Coverage:Seniors may need to consider their coverage needs carefully. For example, they may want to consider adding additional coverage for medical payments or uninsured motorist protection.

- Discounts and Special Programs:Seniors should look for discounts and special programs offered by insurance companies. Many companies offer discounts for seniors who are accident-free, have good driving records, or have taken a defensive driving course.

Importance of Considering Discounts and Special Programs

It’s crucial for seniors to explore discounts and special programs designed for their age group. These programs can help seniors save money on their car insurance premiums while ensuring they have adequate coverage.

- Defensive Driving Courses:Many insurance companies offer discounts to seniors who complete a defensive driving course. These courses teach seniors how to drive safely and avoid accidents.

- Good Driver Discounts:Seniors with good driving records may qualify for good driver discounts. This means they have not been involved in any accidents or traffic violations.

- Senior Citizen Discounts:Some insurance companies offer specific discounts for seniors. These discounts may be based on age, driving experience, or other factors.

Key Factors to Consider When Choosing Car Insurance: What Are The Best Car Insurance Companies For Seniors

Choosing the right car insurance policy can be a daunting task, especially for seniors. It’s crucial to compare different options and consider your individual needs to find the best coverage at a reasonable price. Here are some key factors to keep in mind:

Coverage Options

Understanding the different types of car insurance coverage is essential for making an informed decision. These coverages protect you financially in various scenarios, such as accidents, theft, and natural disasters.

- Liability Insurance: This is the most basic type of car insurance, and it’s typically required by law. It covers damages to other people’s property or injuries caused by you in an accident. Liability insurance usually includes two components: bodily injury liability and property damage liability.

- Collision Insurance: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who’s at fault. It’s generally optional, but it’s a good idea if you have a newer car or a loan on your vehicle.

- Comprehensive Insurance: This coverage protects your vehicle against damages from non-collision events, such as theft, vandalism, fire, or natural disasters. Like collision insurance, it’s usually optional but highly recommended for newer or high-value vehicles.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s essential to have this coverage, as it can help you recover your losses in such situations.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who’s at fault in an accident. It’s optional but can be helpful if you have a high deductible on your health insurance.

Benefits of Different Car Insurance Policies

Here’s a table that compares different types of car insurance policies and their benefits:

| Policy Type | Benefits |

|---|---|

| Liability Insurance | Covers damages to other people’s property or injuries caused by you in an accident. |

| Collision Insurance | Pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who’s at fault. |

| Comprehensive Insurance | Protects your vehicle against damages from non-collision events, such as theft, vandalism, fire, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. |

| Medical Payments Coverage | Pays for medical expenses for you and your passengers, regardless of who’s at fault in an accident. |

Top Car Insurance Companies for Seniors

Choosing the right car insurance company can be overwhelming, especially for seniors who may have unique needs and considerations. This section will guide you through some of the top car insurance companies known for their senior-friendly policies, helping you make an informed decision.

Reputable Car Insurance Companies for Seniors

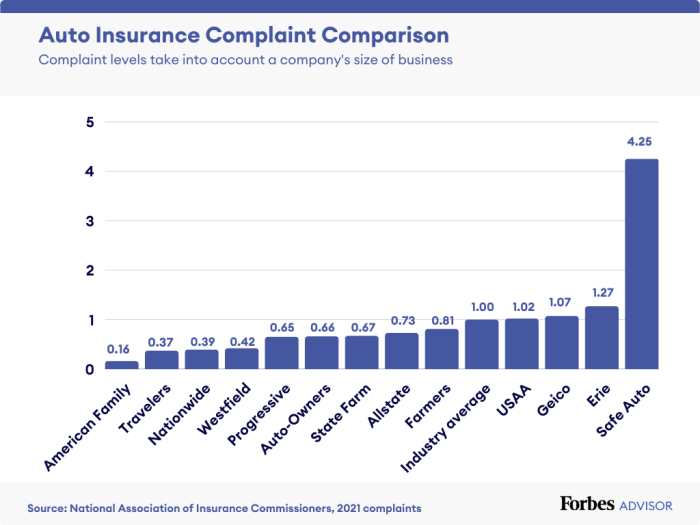

It’s important to consider several factors when choosing a car insurance company, including pricing, discounts, customer service, and coverage options. The following companies are known for their senior-friendly policies and have consistently received positive reviews:

- AARP:AARP offers competitive rates and discounts specifically for seniors, along with a strong reputation for customer service. They provide a wide range of coverage options, including accident forgiveness, which can be valuable for seniors who may be more prone to accidents.

- State Farm:State Farm is a well-established and reliable insurance provider with a strong network of agents. They offer a variety of discounts for seniors, including safe driver discounts, multi-policy discounts, and discounts for seniors who complete defensive driving courses.

- GEICO:GEICO is known for its affordable rates and convenient online and mobile services. They offer discounts for seniors, including good driver discounts, multi-car discounts, and discounts for seniors who have completed defensive driving courses. Their online platform is user-friendly and makes it easy to manage your policy.

- Allstate:Allstate offers a wide range of coverage options and discounts for seniors, including discounts for safe drivers, multi-policy holders, and seniors who have completed defensive driving courses. They also offer Drive Safe & Save, a program that uses telematics to track driving habits and provide discounts based on safe driving.

- Progressive:Progressive is known for its customizable coverage options and innovative features, including Name Your Price, which allows you to set your desired price and then see which coverage options fit your budget. They offer discounts for seniors, including good driver discounts, multi-car discounts, and discounts for seniors who have completed defensive driving courses.

Comparing Key Features and Benefits

The following table summarizes the key features and benefits offered by each company:

| Company | Pricing | Discounts | Customer Service | Coverage Options |

|---|---|---|---|---|

| AARP | Competitive rates for seniors | Safe driver, multi-policy, defensive driving course | Excellent reputation for customer service | Accident forgiveness, comprehensive coverage |

| State Farm | Competitive rates, may vary by location | Safe driver, multi-policy, defensive driving course | Strong network of agents, good customer service | Comprehensive coverage, optional add-ons |

| GEICO | Affordable rates, often lower than competitors | Good driver, multi-car, defensive driving course | Convenient online and mobile services, good customer service | Comprehensive coverage, optional add-ons |

| Allstate | Rates can be competitive, may vary by location | Safe driver, multi-policy, defensive driving course, Drive Safe & Save | Good customer service, available through various channels | Comprehensive coverage, optional add-ons |

| Progressive | Customizable rates, Name Your Price feature | Good driver, multi-car, defensive driving course | Good customer service, available through various channels | Comprehensive coverage, optional add-ons |

Discounts and Special Programs for Seniors

Insurance companies recognize that senior drivers often have a lower risk profile than younger drivers, and they offer various discounts and programs to reflect this. These programs can help seniors save money on their car insurance premiums while ensuring they have adequate coverage.

Discounts Available to Seniors

Senior discounts are one of the most common ways insurance companies reward older drivers for their experience and safety records. Here are some common discounts available:

- Senior Citizen Discount:This is a general discount offered to drivers who are 55 years old or older. The discount amount can vary depending on the insurance company and the driver’s individual risk profile.

- Safe Driver Discount:Senior drivers with a clean driving record and no accidents or violations in a specified period, often five years, may qualify for this discount. This discount reflects their safe driving habits and lower risk of accidents.

- Defensive Driving Course Discount:Completing a defensive driving course designed for senior drivers can demonstrate a commitment to safe driving practices and may qualify for a discount. These courses typically cover topics like safe driving techniques, common driving hazards for older drivers, and strategies for avoiding accidents.

- Multiple Policy Discount:If you bundle your car insurance with other insurance policies like homeowners or renters insurance, you can often receive a discount. This applies to seniors as well.

- Good Student Discount:While this discount is typically associated with younger drivers, some insurance companies may offer it to seniors who are enrolled in college or university courses. This discount rewards drivers who are actively pursuing education.

Special Programs for Senior Drivers

Some insurance companies offer special programs tailored specifically to meet the unique needs of senior drivers. These programs can provide additional support, resources, and discounts:

- Senior Driver Programs:These programs provide tailored services and resources to help senior drivers stay safe on the road. This can include access to driver safety courses, vehicle modifications, and support for maintaining driving skills.

- Low-Mileage Discounts:If you are a senior driver who drives fewer miles than average, you may qualify for a discount based on your lower risk of being involved in an accident. This discount is particularly beneficial for seniors who have retired or are less active drivers.

- Telematics Programs:These programs utilize telematics devices that track your driving habits and provide feedback on your driving performance. Senior drivers who demonstrate safe driving practices through telematics programs may qualify for discounts.

Maximizing Savings

Seniors can maximize their savings on car insurance by:

- Comparing quotes from multiple insurance companies:This allows you to find the best rates and discounts available.

- Taking advantage of available discounts:Make sure to inquire about all possible discounts, including senior citizen, safe driver, defensive driving course, and multiple policy discounts.

- Reviewing your policy regularly:Ensure that your coverage is still adequate and that you are not paying for unnecessary features.

- Consider driving less:Reducing your mileage can significantly lower your insurance premiums, especially if you qualify for a low-mileage discount.

Tips for Finding the Best Car Insurance for Seniors

Finding the right car insurance policy as a senior can be a bit overwhelming, but with a little research and effort, you can find the best coverage for your needs at a reasonable price. Here are some tips to help you navigate the process.

Compare Quotes from Multiple Companies

It’s crucial to get quotes from multiple car insurance companies to compare prices and coverage options. Don’t just settle for the first quote you receive. Each company has its own pricing structure and may offer different discounts and benefits.

Carefully Review Policy Details and Coverage Options

Once you have a few quotes, carefully review each policy’s details. Pay attention to the following:

- Deductibles:A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means a lower premium. Consider your financial situation and how much risk you’re willing to take on when deciding on a deductible.

- Coverage Limits:Coverage limits determine the maximum amount your insurance company will pay for a covered claim. Make sure the limits are sufficient to cover your potential losses.

- Discounts:Most insurance companies offer discounts for seniors, such as safe driving records, multiple vehicle discounts, and bundling home and auto insurance. Ask about all available discounts and see if you qualify.

- Special Programs:Some insurance companies have special programs designed specifically for seniors, such as driver training courses that can help you qualify for discounts.

Additional Resources for Seniors

Finding the right car insurance for seniors can feel overwhelming, but there are resources available to help navigate the process. Organizations and websites dedicated to assisting seniors with insurance and financial matters can provide valuable information, guidance, and support.

Organizations Dedicated to Senior Support

Several organizations focus on advocating for and assisting seniors with various aspects of their lives, including insurance. These organizations offer valuable resources and information on car insurance for seniors, helping them make informed decisions and access available benefits.

- AARP (American Association of Retired Persons):AARP provides a wealth of resources for seniors, including information on car insurance, discounts, and programs specifically designed for older drivers. Their website and publications offer tips on finding affordable coverage and understanding policy details. Website: https://www.aarp.org/ Phone: 1-800-424-2277

- National Council on Aging (NCOA):NCOA is a non-profit organization dedicated to improving the lives of older adults. They offer resources on various topics, including insurance, and have a dedicated section on car insurance for seniors. Website: https://www.ncoa.org/ Phone: 1-800-222-2255

- Consumer Reports:Consumer Reports provides independent and unbiased reviews of products and services, including car insurance. They offer detailed information on different insurance companies, their policies, and customer satisfaction ratings. Website: https://www.consumerreports.org/ Phone: 1-800-234-8060

Government Resources

Government agencies also offer resources and programs designed to support seniors, including those related to car insurance. These resources can provide valuable information on discounts, financial assistance, and safety programs for older drivers.

- The National Highway Traffic Safety Administration (NHTSA):NHTSA provides information on safe driving practices for older adults, including tips on maintaining driving skills and adapting to changes in vision and reaction time. Website: https://www.nhtsa.gov/ Phone: 1-888-327-4236

- The Federal Trade Commission (FTC):The FTC provides information on consumer protection and offers resources on avoiding insurance scams and fraudulent practices. Website: https://www.ftc.gov/ Phone: 1-877-382-4357

Key Contact Information for Senior-Specific Car Insurance Resources

“For personalized assistance and guidance on car insurance for seniors, contact AARP at 1-800-424-2277 or visit their website at https://www.aarp.org/ . The National Council on Aging offers resources on insurance and other senior-related matters at 1-800-222-2255 or https://www.ncoa.org/ .”

Concluding Remarks

Finding the best car insurance for seniors is all about understanding your needs and comparing options. Don’t be afraid to ask questions, get quotes from multiple companies, and take advantage of any discounts you qualify for. With a little research and the right information, you can find a policy that provides the coverage you need at a price you can afford.

Commonly Asked Questions

What are some common discounts for seniors?

Many companies offer discounts for seniors, including safe driver discounts, good student discounts, and multi-car discounts. You might also qualify for discounts if you take a defensive driving course or install anti-theft devices in your car.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year, or even more often if your driving habits change. You may be able to find better rates or coverage options as your needs evolve.

What happens if I have a claim?

If you have a claim, your insurance company will handle the process of filing the claim and dealing with any repairs or medical expenses. It’s important to understand the details of your policy, including deductibles and coverage limits, so you know what to expect in the event of a claim.