What is the best insurance for homeowners? It’s a question every new homeowner asks, and for good reason. Finding the right insurance can be a real headache, especially when you’re dealing with all the other things that come with buying a house.

But don’t worry, we’re here to break it down for you.

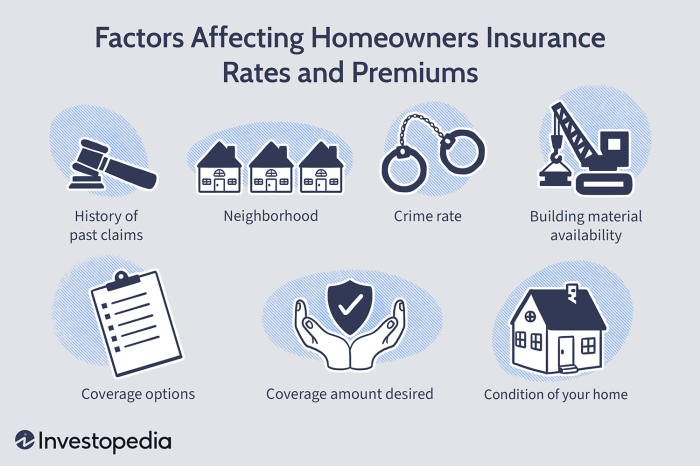

Home insurance is designed to protect your biggest investment – your home – from unexpected events like fires, theft, and natural disasters. But it’s not a one-size-fits-all solution. There are different types of coverage, deductibles, and factors that influence your premium.

Understanding these things is key to finding the right policy for your needs and budget.

Obtaining Quotes and Making a Decision

After you’ve done your research and determined the type of coverage you need, it’s time to start shopping around for quotes. Getting quotes from multiple insurance providers is crucial to finding the best deal.

Comparing Insurance Quotes

It’s important to compare quotes from different insurance companies to ensure you’re getting the best value for your money.

- Use online comparison tools: Many websites allow you to enter your information once and receive quotes from multiple insurers. This can save you time and effort.

- Contact insurance companies directly: You can also contact insurance companies directly to request a quote. Be sure to have all the necessary information on hand, such as your address, property details, and coverage requirements.

- Consider your specific needs: When comparing quotes, be sure to consider your individual needs and priorities. For example, if you have valuable possessions, you may want to choose a policy with higher coverage limits.

Negotiating Insurance Premiums

Once you have a few quotes, you may be able to negotiate lower premiums. Here are some tips:

- Ask about discounts: Many insurers offer discounts for various factors, such as bundling policies, having safety features in your home, or being a good driver. Be sure to ask about any available discounts.

- Shop around for better rates: Even if you’re happy with your current insurer, it’s a good idea to shop around every few years to see if you can find a better deal. You may be surprised at the savings you can find.

- Consider increasing your deductible: A higher deductible means you’ll pay more out of pocket if you have a claim, but it can also lower your premium. This may be a good option if you’re looking to save money and are confident you can afford a higher deductible.

Understanding Policy Terms and Conditions

Before signing up for coverage, it’s essential to carefully read and understand the terms and conditions of the policy. This will help you avoid any surprises down the road.

- Coverage limits: This refers to the maximum amount the insurer will pay for a claim. Be sure to choose coverage limits that are sufficient for your needs.

- Exclusions: Policies often have exclusions, which are specific events or situations that are not covered. It’s important to understand what is and isn’t covered by your policy.

- Deductibles: This is the amount you’ll pay out of pocket for a claim before the insurer starts paying. A higher deductible generally means a lower premium.

Managing Your Home Insurance Policy

Keeping your home insurance policy up-to-date is crucial for ensuring you have the right coverage when you need it. This means staying on top of changes in your property, your needs, and your contact information. It also means understanding the claims process and knowing how to file a claim if you experience a covered event.

Maintaining Accurate Information

Keeping your insurance company informed about any changes to your property or your coverage needs is essential. This includes:

- Property Value:As your home’s value increases, you may need to adjust your coverage limits to ensure you’re fully protected in case of a loss. This can be influenced by factors like renovations, market fluctuations, or even the addition of valuable belongings.

- Coverage Needs:If your lifestyle or family situation changes, your insurance needs may also change. For example, if you acquire expensive jewelry or artwork, you may need to add riders to your policy for additional coverage. Similarly, if you start a home-based business, you’ll need to adjust your coverage to include business property and liability.

- Contact Details:Make sure your insurance company has your current phone number, email address, and mailing address. This ensures they can reach you quickly in case of an emergency or if there’s an important update regarding your policy.

Understanding the Claims Process, What is the best insurance for homeowners?

Knowing how to file a claim in case of an incident is critical. This includes:

- Reporting the Claim:Contact your insurance company as soon as possible after an incident. They’ll provide instructions on how to report the claim and what information you’ll need to provide.

- Documentation:Gather all relevant documentation, such as photos, receipts, and repair estimates. This helps support your claim and ensure you receive the correct compensation.

- Cooperation:Cooperate fully with your insurance company’s investigation. This may involve providing additional information, scheduling inspections, or meeting with adjusters.

Minimizing Risks and Preventing Claims

Taking steps to minimize risks and prevent potential claims can help reduce your insurance premiums and protect your home:

- Home Security:Installing a home security system with alarms, motion detectors, and surveillance cameras can deter potential burglars and lower your risk of theft.

- Preventative Maintenance:Regular maintenance can help prevent accidents and damage. This includes checking and cleaning smoke detectors, maintaining your roof and gutters, and ensuring your electrical wiring is up to code.

- Fire Safety:Install smoke detectors on every floor of your home and ensure they are working properly. Keep flammable materials away from heat sources and have a fire escape plan in place.

- Water Damage Prevention:Check for leaks and water damage regularly, and ensure your plumbing system is in good condition. Consider installing a water leak detection system to alert you to potential issues.

Last Word: What Is The Best Insurance For Homeowners?

So, what’s the best home insurance for you? The answer depends on your individual circumstances, but hopefully this guide has given you a good starting point. Remember to shop around, compare quotes, and don’t be afraid to ask questions. After all, protecting your home is a big responsibility, and getting the right insurance is a crucial step in that process.

Popular Questions

What is a deductible?

A deductible is the amount of money you pay out of pocket before your insurance kicks in to cover the rest of the cost of a claim. The higher your deductible, the lower your premium will be.

How often should I review my home insurance policy?

It’s a good idea to review your policy at least once a year, especially if you’ve made any major changes to your home or your lifestyle, such as adding a new room or getting a pet.

What are some common discounts I can get on home insurance?

Many insurance companies offer discounts for things like having a security system, smoke detectors, and fire extinguishers in your home. You may also be able to get a discount if you bundle your home and auto insurance together.